35+ Roth conversion tax calculator 2020

Enter as a percentage but without the percent sign for 15 or 15 enter 15. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track.

How To Build An Excel Model For Income Tax Brackets Quora

March 21 2021 926 PM.

. Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. Ad Official Site - Open A Merrill Edge Self-Directed Investing Account Today. Roth IRA Conversion Calculator In 1997 the Roth IRA was introduced.

Roth IRA Conversion Calculator. Get Up To 600 When Funding A New IRA. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

Use the calculator below to examine your own situation. Enter your age when youll. Based on your taxable income state of residence and filing status weve estimated your federal and state marginal tax rate as follows.

Connect With A Prudential Financial Professional Online Or By Phone. Explore Choices For Your IRA Now. The conversion amount is taxable but you have full flexibility in choosing how much to.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Connect With A Prudential Financial Professional Online Or By Phone. The SECURE Act of 2019 changed the age that RMDs must begin.

Here are the inputs to edit. Roth Ira Calculator Roth Ira Contribution Current age 1 to 120 Age when income should start 1 to 120 Number of years to receive income 1 to 30 Before-tax. Your IRA could decrease 2138 with a Roth.

Federal tax rate 2500 State tax rate -- View federal. When planning for retirement there are a number of key decisions to make. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

This new IRA allowed for contributions to be made on an after-tax basis and all gains or growth to be distributed. Consider The Different Types Of IRAs. Discover if a Roth IRA conversion will work for your portfolio in 99 Retirement Tips.

Inputs to the Conversion Tool. This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. Clicked the drop down arrow to select up to the 22 Tax Bracket Converting up to the 22 bracket my additional Roth conversion for the year is 104050 the projected.

Enter your age today or the age you will be when you convert the IRA. Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. Call 866-855-5635 or open a Schwab IRA today.

One big decision is whether or not you should convert your traditional IRA into a Roth IRA. Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. Please enter the following information Current age What age do you plan to retire.

Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will generally pay ordinary income tax on the taxable amount that is converted. This convert IRA to Roth calculator estimates the change in total net worth at retirement if you convert a traditional IRA into a Roth IRA. Projected tax rate at retirement Assumed.

Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your. Use the tool to compare estimated taxes when you do nothing convert up to a specific. Ad Find Out Whether Converting Is Beneficial For You.

The information in this tool includes education to help. Roth IRA Conversion Calculator. Here are some reasons to consider a Roth conversion this year No RMD in 2020.

It is mainly intended for use by US. 25 28 33 or 35. Schwab Is Here To Answer Your Questions And Help You Through The Process.

If you were born on or after. Federal income tax bracket during retirement No. This calculator can help you make informed decisions about performing a Roth conversion in 2022.

There are many factors to consider including the amount to convert current tax rate and your age. I have been following this topic to enter the backdoor Roth IRA conversion into TurboTax 2020 Home and.

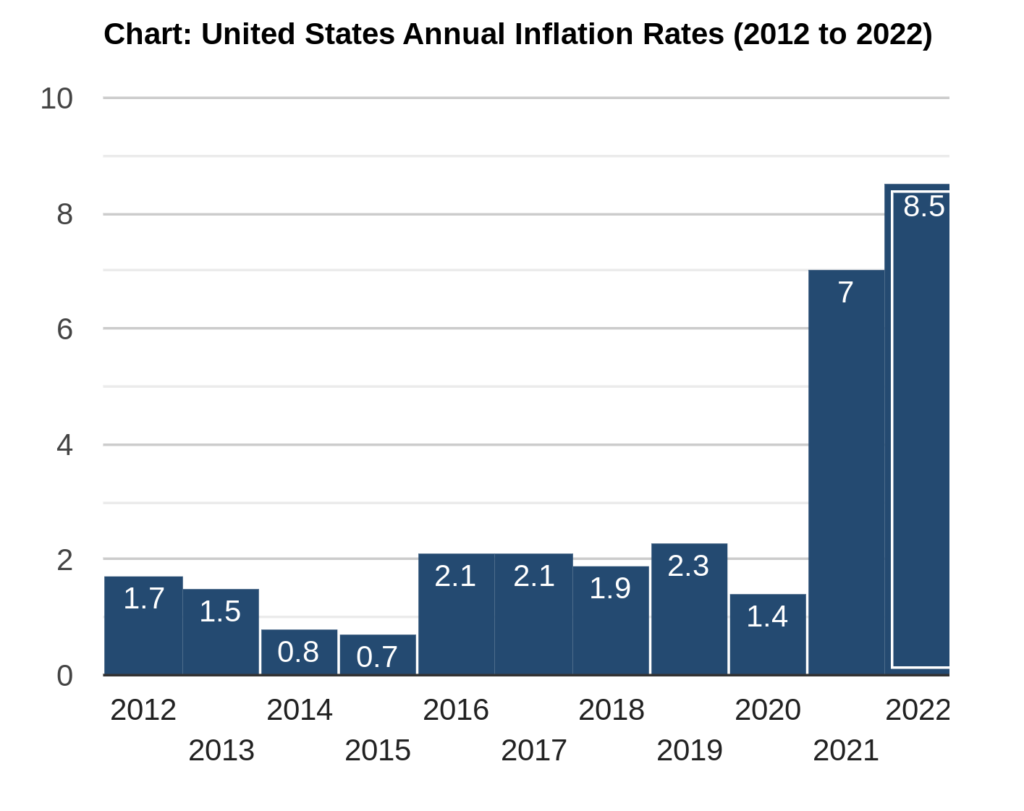

May 2022 National Survey Nearly 4 In 5 Americans Haven T Taken Action To Hedge Against Inflation 14 6 Have Added Real Assets

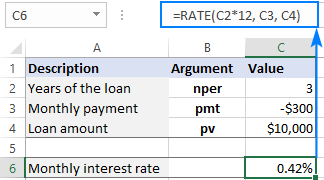

Using Rate Function In Excel To Calculate Interest Rate

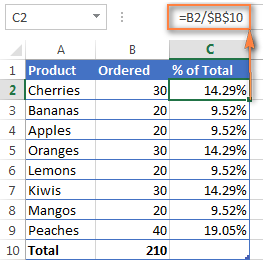

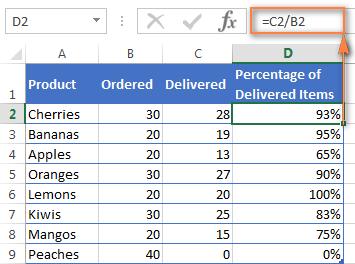

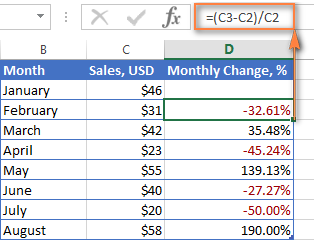

How To Calculate Percentage In Excel Percent Formula Examples

Roth Vs Traditional Ira How To Choose Family And Fi Roth Ira Investing Traditional Ira Roth Ira

How To Calculate The Ending Cash Balance Quora

Roth Ira So Let S Say You Put Away The Maximum 5 500 Each Year And Continue To Put Away That Amount Adjusted For Inflation Wealth Building Roth Ira Wealth

How To Build An Excel Model For Income Tax Brackets Quora

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

Download Roth Ira Calculator Excel Template Exceldatapro Roth Ira Calculator Roth Ira Ira

How To Build An Excel Model For Income Tax Brackets Quora

How To Calculate Percentage In Excel Percent Formula Examples

How To Calculate Percentage In Excel Percent Formula Examples

Form 1040 Income Tax Return Irs Tax Forms Tax Forms

Find The Federal And State Income Tax Forms You Need For 2019 Official Irs Tax Forms With Instructions Are Printable And Can Be Income Tax Irs Taxes Tax Forms

How To Build An Excel Model For Income Tax Brackets Quora

How To Build An Excel Model For Income Tax Brackets Quora

What Are Roth Ira Accounts Nerdwallet Roth Ira Individual Retirement Account Ira Investment